How would you like to be remembered?

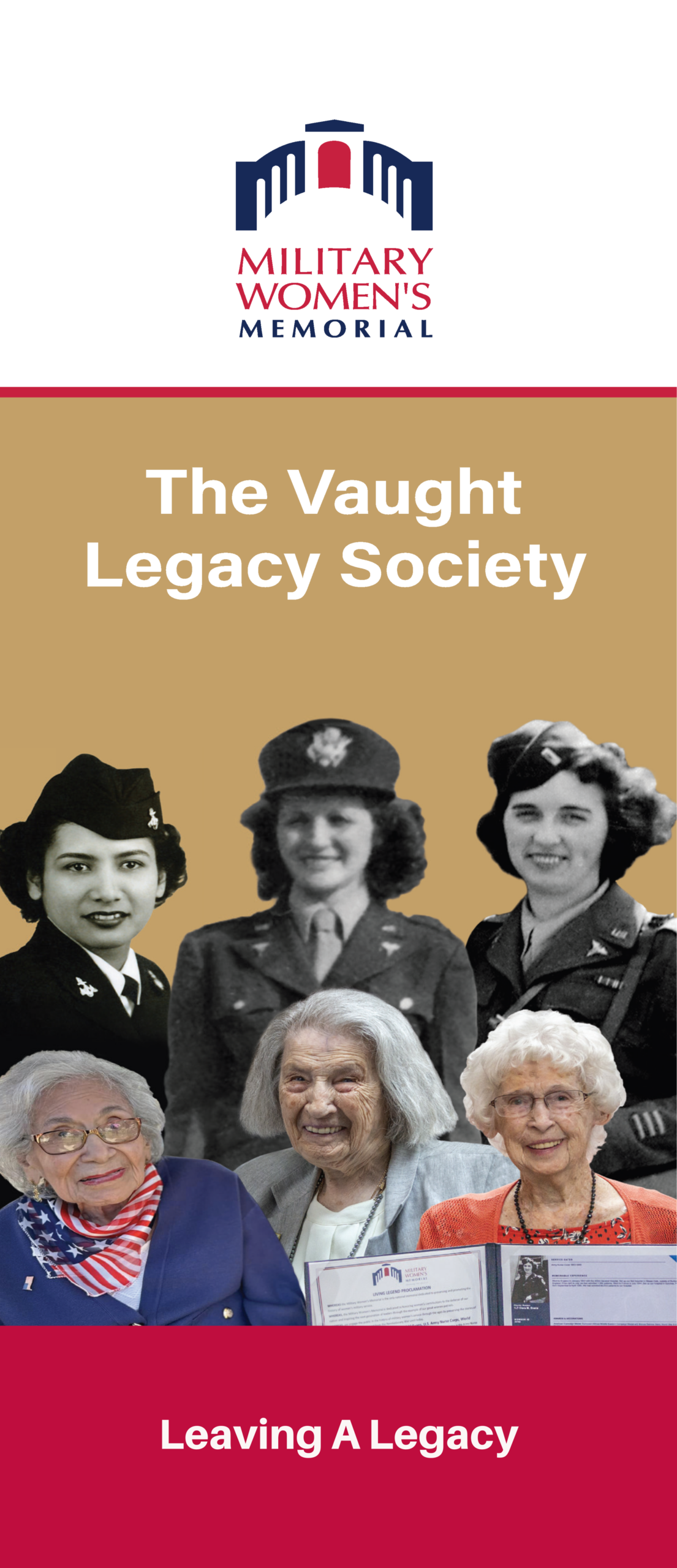

THE VAUGHT LEGACY SOCIETY

Leaving Your Legacy

The Vaught Legacy Society honors those who choose to make a lasting commitment to the Military Women’s Memorial through planned giving. By including the Memorial in your estate plans, you help ensure that the stories, service, sacrifice, and leadership of America’s military women are preserved, honored, and shared for generations to come.

Legacy gifts provide enduring support for the Memorial’s mission—ensuring that every woman who served remains a visible and valued part of our Nation’s history.

Letting us know of your intentions to support the memorial through planned giving allows us to honor your generosity, plan responsibly for the future, and steward your gift.

Take a look at our Vaught Legacy Society literature to learn more about the Vaught Legacy Society and leaving a planned legacy gift to the Memorial.

We are deeply grateful to those who choose to stand with us in this meaningful way.

If you have included—or plan to include—the Military Women’s Memorial in your estate plans, we invite you to complete a Letter of Intent for a Planned Gift. Once your form is received, you will be recognized as an official member of the Vaught Legacy Society.

Please send completed forms to:

Military Women’s Memorial

200 N. Glebe Rd., Suite 400

Arlington, VA 22203

Or email: [email protected]

Thank you for helping carry this mission forward—honoring the past, supporting the present, and safeguarding the future of women’s service to our Nation.

Members and friends may support the Military Women’s Memorial in a number of ways. The most common forms of giving are outright gifts of cash and securities, but there are other types of assets that may be donated as well and planned giving options that have favorable financial and tax benefits.

Planned gifts include bequests, charitable trusts (remainder and lead), gifts of retirement plan assets, gifts of life insurance policies, and gifts of tangible personal property. We would be pleased to work with you and your advisors to structure a gift that best fulfills your charitable goals and how you wish to be remembered. Please contact our finance department at 703-822-7270 or [email protected] for more information.

Bequests

Most legacy gifts cost you nothing now. No immediate contribution is needed, and you can change your mind at any time. Once your family and friends are provided for, we hope you’ll consider making the Memorial part of your legacy.

In addition to filling an important role in providing for the future financial security of your family and friends, your will or living trust offers a way for you to weave women veterans into your life story. It is satisfying to know that a portion of your property will be put to vital long-term use ensuring the role of women in military service to our nation is forever told.

Bequests (specific, residuary, and contingent gifts made by will) are the most popular type of planned gift and have been crucial (along with remainders from charitable trusts) to the extraordinary growth and success of the Military Women’s Memorial since its founding. Whether you wish to provide general operating income for the Memorial to use wherever it is most needed or to support a specific program, your bequest expresses your lasting commitment to the Memorial. A bequest to the Memorial may also help you meet your financial and estate-planning goals since an estate-tax charitable deduction for the entire amount of the gift is allowed.

Giving Through Wills or Living Trusts

A gift made through a will or living trust is convenient to arrange. A simple provision or amendment prepared by your attorney at the time you make or update your will or trust is all that is necessary. Gifts included in wills and living trusts are popular because they are flexible, easy to arrange, and may be changed with your life circumstances.

Here are the most popular ways to give through wills and trusts:

- Make a gift of a specific amount.

- Make a gift of a percentage of your estate.

- Give the remainder, or residue, of your estate to the Military Women’s Memorial—that is, what remains after all other bequests to friends and loved ones are satisfied.

- Provide for a gift of a particular property. Real estate, stocks, and other items of value are examples of properties that can be used to fund charitable bequests.

- Name charitable interests to receive a bequest in the event other heirs are not there to receive their legacies.

There is no limit on amounts deductible from federal gift and estate taxes for charitable gifts made by will or trust. No tax will be due on assets which are given in this way. To plan a charitable gift through your will or living trust, inform your attorney of your wishes.

Additional Information About Living Trusts

A living trust is a written legal document that partially substitutes for a will. With a living trust, your assets (your home, bank accounts and stocks, for example) are put into the trust. It is administered for your benefit during your lifetime, and then transferred to your living and charitable beneficiaries when you die.

Most people name themselves as the trustee in charge of managing their trust’s assets. This way, even though your assets have been put into the trust, you remain in control of your assets during your lifetime. You can also name a successor trustee (a person or an institution) who will manage the trust’s assets if you ever become unable or unwilling to do so yourself.

The benefits sought in creating such a trust include:

- Bypass estate administration (“probate”).

- Gives the trustee the legal right to manage and control the assets held in your trust.

- Instructs the trustee to manage the trust’s assets for your benefit during your lifetime.

- Obtain privacy regarding one’s estate plan. If the trust contains real estate the trust agreement generally will have to be recorded and will then become a matter of public record.

- Names the beneficiaries (persons or charitable organizations) who are to receive your trust’s assets when you die.

Trusts should always be drafted or reviewed by your attorney or other advisors.

Charitable Remainder Trusts

Charitable remainder trusts allow you to make a gift to the Memorial and at the same time retain a benefit from the assets you give. These separately managed trusts can be tailored to meet your financial goals with respect to the payout rate, type of income stream (variable or fixed), and payment schedule. To establish a remainder trust, you make an irrevocable contribution of cash, securities, or other property, which is placed in trust. The trust pays an income stream to one or more named beneficiaries (which can include you) for life and/or for a set term of years (not to exceed 20), and the Memorial receives the right to principal as a remainder interest. The two most common types of charitable remainder trust are: (1) the annuity trust, which pays a fixed dollar amount each year based on a percentage (at least 5%) of the initial fair market value of the trust assets; and (2) the unitrust, which pays a variable income stream based on a percentage (again, at least 5%) of the fair market value of trust assets as revalued each year. A deferral feature is available for charitable remainder unitrusts. Because charitable remainder trusts (like an IRA or 401(k)) are tax-exempt, this deferral feature can make them a useful retirement planning tool if you are able to defer your receipt of an income stream. Charitable remainder trusts are typically funded with assets worth $100,000 or more. Establishing such a trust generally entitles you to claim an immediate income-tax charitable deduction.

Charitable Lead Trusts

A charitable lead trust is the reverse of a charitable remainder trust; the gift to the Memorial is the income stream from the trust, not the remainder. Charitable lead trusts enable you to provide an income stream to the Memorial immediately for a set term of years or for a term measured by one or more lifetimes after which the trust assets pass to you or your estate or to your heirs. Leaving the asset to heirs can significantly reduce the gift or estate tax that would otherwise apply.

Retirement Plan Assets

Assets in qualified (tax-deferred) retirement plans may represent a large portion of your total assets and therefore may be an important factor in planning testamentary charitable gifts. Retirement assets generally considered suitable for charitable gifts include such plans as IRAs, Keoghs, SEPs, 401(k)s, 403(b)s, and ESOPs.

Left to family members or friends, these assets are subject to income tax and may also be subject to estate tax and generation skipping transfer tax. Because of this potential double layer of tax, retirement plan assets may be particularly attractive as an asset to leave to the Memorial. In other words, if you designate the Memorial as a beneficiary upon your death of all or a specified percentage of a retirement plan, the portion of the plan payable to the Memorial will generally escape estate taxes, and the Memorial, as a tax-exempt institution, will not be required to pay income tax on the distributions. As a general rule, if you intend to make both noncharitable and charitable gifts at death, it makes sense to consider using your tax-deferred retirement plan assets for charity and other assets for heirs.

Life Insurance Policies

Naming the Memorial the beneficiary of an existing life insurance policy that is no longer needed to provide for dependents offers a simple way to support us. Since you are the policy owner, the value of the policy will be included in your estate, but an offsetting estate-tax charitable deduction will generally be allowed. You may also be able to assign an existing whole life policy to the Memorial, irrevocably making us the owner and beneficiary, and claim an income-tax charitable deduction for the lesser of either your basis in the policy or its fair market value in that year. If the policy is not paid up and additional premium payments are due, you may donate cash or the equivalent to the Memorial to pay the premiums and claim a full tax deduction for the gift. Lastly, you may be able to purchase a new policy naming the Memorial as owner and beneficiary, pay the annual premiums (through us), and claim the premium amount as a charitable contribution.